10-K: Annual report [Section 13 and 15(d), not S-K Item 405]

Published on April 15, 2025

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

(Mark One)

For the fiscal year ended

For the transition period from to

Commission File Number:

(Exact name of registrant as specified in its charter)

| (State or other jurisdiction of incorporation or organization) | (IRS Employer Identification No.) |

|

| (Address of principal executive offices) | (Zip Code) |

(Registrant’s telephone number, including area code)

Not applicable

(Former name, former address and former fiscal year, if changed since last report)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||

Securities registered pursuant to Section 12(g) of the Act: None.

Indicate by check mark if the registrant is a

well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐

Indicate by check mark if the registrant is not

required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐

Indicate by check mark whether the registrant

(1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months

(or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements

for the past 90 days.

Indicate by check mark whether the registrant

has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (Section 232.405

of this chapter) during the preceding 12 months (or such shorter period that the registrant was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act:

| Large accelerated filer | ☐ | Accelerated filer | ☐ |

| ☒ | Smaller reporting company | ||

| Emerging growth company |

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act.

Indicate by check mark whether the registrant

has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial

reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or

issued its audit report.

If securities are registered pursuant to Section

12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction

of an error to previously issued financial statements.

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant

is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No

As of June 28, 2024, the last business day of

the registrant’s last completed second quarter, there was

As of April 15, 2025, there were

TABLE OF CONTENTS

i

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

Various statements in this Annual Report on Form 10-K (the “Annual Report”) of Apimeds Pharmaceuticals US, Inc. are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements involve substantial risks and uncertainties. All statements, other than statements of historical facts, included in this report, including statements regarding our strategy, future operations, future financial position, future revenues, projected costs, prospects, plans and objectives of management are forward-looking statements. These statements are subject to risks and uncertainties (some of which are beyond our control) and are based on information currently available to our management. Words such as “anticipate,” “believe,” “estimate,” “expect,” “intend,” “may,” “plan,” “contemplates,” “predict,” “project,” “target,” “likely,” “potential,” “continue,” “ongoing,” “will,” “would,” “should,” “could,” or the negative of these terms and similar expressions or words, identify forward-looking statements. The events and circumstances reflected in our forward-looking statements may not occur and actual results could differ materially from those projected in our forward-looking statements. Such forward-looking statements are based on current expectations and involve inherent risks and uncertainties, including risks and uncertainties that could delay, divert or change these expectations, and could cause actual results to differ materially from those projected in these forward-looking statements. These risks and uncertainties include, but are not limited to, those factors described under Part I, Item 1A: “Risk Factors.” Should one or more of these risks or uncertainties materialize, or should any of our assumptions prove incorrect, actual results may vary in material respects from those projected in these forward-looking statements.

This Annual Report contains market data and industry forecasts that were obtained from industry publications. These data involve a number of assumptions and limitations, and you are cautioned not to give undue weight to such estimates. We have not independently verified any third-party information. While we believe the market position, market opportunity and market size information included in this report is generally reliable, such information is inherently imprecise and subject to change.

All written and oral forward-looking statements attributable to us or any person acting on our behalf are expressly qualified in their entirety by the cautionary statements contained or referred to in this section. We caution investors not to rely on the forward-looking statements we make or that are made on our behalf as predictions of future events. We undertake no obligation and specifically decline any obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as may be required under applicable securities laws.

We encourage you to read the management’s discussion and analysis of our financial condition and results of operations and our financial statements contained in this Annual Report. There can be no assurance that we will in fact achieve the actual results or developments we anticipate or, even if we do substantially realize them, that they will have the expected consequences to, or effects on, us. Therefore, we can give no assurances that we will achieve the outcomes stated in those forward-looking statements, projections and estimates.

ii

PART I

Item 1. Business

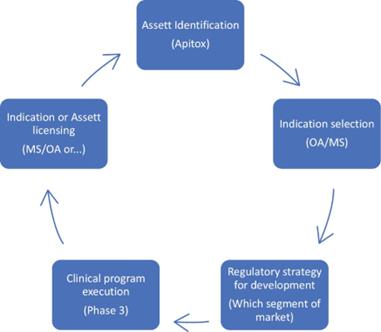

We are a clinical stage biopharmaceutical company in the process of developing Apitox, an intradermally administered bee venom-based toxin. Our focus is primarily on developing innovative therapies that address inflammation and pain management symptoms associated with knee OA and, to a lesser extent, MS. Apitox is currently marketed and sold by Apimeds Inc. (“Apimeds Korea”) in South Korea as “Apitoxin” for the treatment of OA. Apimeds US is not associated with the market, sale and revenues generated from Apitoxin in South Korea, and Apitoxin has not yet been approved by the FDA for any indication.

Apitox is a purified, pharmaceutical grade venom (bee venom), of the Apis mellifera, or western honeybee, which is classified by the FDA as an active pharmaceutical ingredient (“API”). Bee venom has been used in Asia and Europe to treat pain for hundreds of years. While not FDA approved in a controlled, prescription based biologic environment for defined indications, the use of bee venom has been FDA approved as a “under the skin injection” to reduce the allergic reactions to bee stings. Apimeds Korea has developed a proprietary method and process for turning extracted bee venom into a lyophilized powder for reconstitution prior to intradermal dose injections, which they sell in South Korea as Apitoxin. We intend to use a similar process with respect to Apitox, pursuant to the Business Agreement, which gives us a license to utilize all prior clinical development data associated with Apitoxin. The advancement of extracted bee venom for treatment of inflammatory conditions, including but not limited to knee OA and MS is speculative but based on direction provided by prior clinical data.

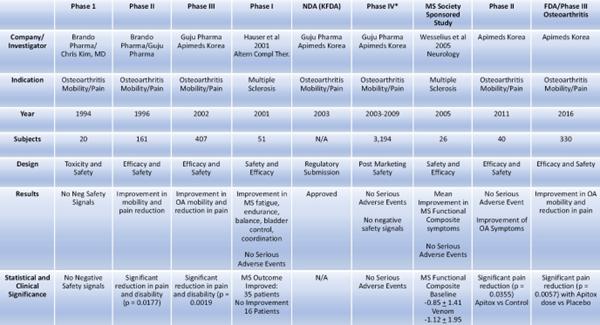

Apimeds Korea successfully completed Phase I, Phase II, and Phase III trials in OA in 2003, at which point Apitoxin was approved by the Korean Ministry of Food and Drug Safety (“MFDA”) to treat pain and mobility in patients with OA. Since 2003, a post-marketing/approval safety study in South Korea followed 3,194 patients from 2003 through 2009, with no serious adverse events. The purpose of a Phase I trial is to test to determine whether a new treatment is safe and look for the best way to give the treatment. Phase II trials test to determine whether a condition or disease responds to the new treatment. Phase III trials test to determine whether a new treatment is better than a standard treatment.

In 2013, the first of two required U.S. Phase III clinical trials was authorized to enroll patients to study the use of Apitoxin to study the same indication as approved in South Korea in 2023 — treatment of pain and lack of mobility in patients with OA (the “Apimeds Korea Phase III OA Trial”). The Apimeds Korea Phase III OA Trial (330 patients) was completed in 2018, and displayed no serious adverse events.

Based on the results from the Apimeds Korea Phase III OA Trial, which demonstrated therapeutic (statistical and clinically significant improvements in all outcome measures of pain, physical function, and disease assessment) effect compared to the placebo group, but in combination with prior development by Apimeds Korea, did not meet the FDA’s standards for approval, as the study population was too small and the methods for handling missing data were inadequate, resulting in a study that did not demonstrate a significant treatment effect. We will be pursuing a second Phase III trial to meet agreed upon FDA standards. Based on results from the Apimeds Korea Phase III OA Trial, we have evaluated the most appropriate population, defined as advanced knee OA patients, which will range from defined grade 2, 3 and 4 within this treatment group, to continue to progress our own Phase III trial. Pursuant to our previous correspondence with the FDA, we have designed and will implement our Phase III trial to best address our patient population, appropriate dosing, and the most effective way to evaluate Apitox in meeting the patient population’s needs.

We believe the progress we are making in clinical trials provides us support in our belief in the potential of Apitox to be an innovative therapy. We aim to treat the inflammation and pain management symptoms associated with knee OA and to help manage the devastating symptoms of this disease. In the future, we also aim to leverage our research in knee OA to investigate how Apitox may be used to treat similar symptoms associated with MS.

Treatment of OA

OA is typically treated with painkillers known as non-steroidal anti-inflammatory drugs (NSAIDs). These medications have an anti-inflammatory and pain-relieving effect. These medications include ibuprofen (Motrin, Advil) naproxen (Aleve) and diclofenac (Voltaren and others). All of these medications work by blocking enzymes that cause pain and swelling. The problem is that some of those enzymes also help blood to clot and protect the lining of your stomach. Without them, you can bruise easily, develop ulcers and may even bleed in your intestines. NSAIDs also increase your chance of heart attack, stroke and heart failure. The risk increases the longer you use them and the more you take. We believe Apitox could be a successful alternative to NSAIDs in the treatment of the inflammation and pain management symptoms associated with OA without the harmful side effects.

1

According to MedicalNewsToday, OA is the most common form of arthritis, affecting around 500 million people worldwide, or around 7% of the global population. Currently, in the United States, over 32 million people suffer from OA. As the 15th highest cause of years lived with disability (YLDs) worldwide, the burden OA poses to individuals is substantial, characterized by pain, activity limitations, and reduced quality of life. The economic impact of OA, which includes direct and indirect (time) costs, is also substantial, ranging from 1 to 2.5% of gross national product (GNP) in countries with established market economies, like the United States. Though trends in OA prevalence vary by geography, the prevalence of OA is projected to rise in regions with established market economies such as North America and Europe, where populations are aging and the prevalence of obesity is rising.

While OA can occur in any joint, it occurs most frequently in the knee, which, according to ScienceDirect, currently accounts for 365 million cases worldwide and 61% of YLDs lost due to OA, followed by the hand.

Our current efforts are focused on the development of Apitox in the United States for the treatment of inflammation and pain management relating to OA in the knee.

Treatment of MS

Additionally, we believe the previous clinical trial success of Apimeds Korea with respect to the use of Apitoxin to treat symptoms associated with knee OA, and pending the success of our anticipated Phase III trial in knee OA, we will be in a position to further explore the use of Apitox as a potential treatment for the symptoms of MS. MS is a chronic disease of the central nervous system. It is an autoimmune condition that is characterized by the body’s own immune cells (macrophages and lymphocytes) attacking the myelin that coats nerve cells, which can lead to inflammation throughout the central nervous system. MS is an unpredictable disease that affects people differently. Some people with MS may have only mild symptoms. Others may lose their ability to see clearly, write, speak, or walk when communication between the brain and other parts of the body becomes disrupted.

MS is the most common progressive neurologic disease of young adults worldwide. A study funded by the National MS Society estimates that nearly one million individuals are currently affected by this disease in the United States. The total economic burden of MS in the United States is estimated to be $85.4 billion, with $63.3 billion in direct medical costs and $22.1 billion in indirect and nonmedical costs. MS typically affects patients at a young age, resulting in a greater loss of productivity and quality of life.

Beta interferon drugs are among the most common medications used to treat MS. Interferons are signaling molecules that regulate immune cells. Potential side effects of these drugs include flu-like symptoms (which usually fade with continued therapy), depression, or elevation of liver enzymes.

Pain from MS can be felt in different parts of the body. Trigeminal neuralgia (facial pain) is treated with anticonvulsant or antispasmodic drugs, or less commonly, painkillers. Central pain, a syndrome caused by damage to the brain and/or spinal cord, can be treated with gabapentin and nortriptyline. Treatments for chronic back or other musculoskeletal pain may include heat, massage, ultrasound, and physical therapy.

OA and the Current Standard of Care

OA is a degenerative joint disease in which the tissues in the joint break down over time. It is the most common type of arthritis and is more common in older people. People with osteoarthritis usually have joint pain and, after rest or inactivity, stiffness for a short period of time.

There are four stages of OA: (1) Minor — minor wear-and-tear in the joints and little to no pain in the affected area, (2) Mild — more noticeable bone spurs, the affected area feels stiff after sedentary periods and patients may need a brace, (3) Moderate — cartilage in the affected area begins to erode, the joint becomes inflamed and causes discomfort during normal activities, and (4) Severe — the patient is in a lot of pain, the cartilage is almost completely gone leading to an inflammatory response from the joint, and overgrowth of bony spurs may cause severe pain.

2

With the progression of OA of the knee, there is obvious joint inflammation which causes frequent pain when walking, running, squatting, extending or kneeling. Along with joint stiffness after sitting for long or when waking up in the morning, there may be popping or snapping sounds when walking.

The data from the Apimeds Korea Phase III OA Trial suggest that Apitox would have the most potential in treating OA in stages 3 and 4.

MS and the Current Standard of Care

MS is increasingly recognized as a neurodegenerative disease triggered by an inflammatory attack of the central nervous system. There is no cure for multiple sclerosis. Treatment typically focuses on speeding recovery from attacks, reducing new radiographic and clinical relapses, slowing the progression of the disease, and managing MS symptoms.

MS is unpredictable and can vary substantially from person to person. MS is divided into four types: clinically isolated syndrome (CIS), relapsing-remitting MS (RRMS), secondary progressive MS (SPMS) and primary progressive MS (PPMS).

CIS refers to a first episode of neurologic symptoms caused by inflammation and demyelination in the central nervous system.

RRMS, the most common disease course, shows clearly defined attacks of new or increasing neurologic symptoms. These attacks are also called relapses or exacerbations. They are followed by periods of partial or complete recovery, or remission. In remissions, all symptoms may disappear or some symptoms may continue and become permanent. However, during those periods, the disease does not seem to progress.

SPMS follows the initial relapsing-remitting course. Some people diagnosed with RRMS eventually go on to have a secondary progressive course, in which neurologic function worsens progressively or disability accumulates over time.

With PPMS, neurologic function worsens or disability accumulates as soon as symptoms appear, without early relapses or remissions. PPMS can be further characterized as either active (with an occasional relapse and/or evidence of new MRI activity over a specified period of time) or not active, as well as with progression (evidence of disability accrual over time, with or without relapse or new MRI activity) or without progression.

Patients with MS tend to be more educated about their disease and better organized than patients with other diseases, resulting in patients that are aggressive in their approach to treatment. This is due to MS impacting otherwise healthy people in the prime of their lives.

MS treatment has undergone significant evolution in the last ten years with the development and approval of certain new drugs, including several oral agents such as Ocrevus, in the United States. These new agents not only give patients additional treatment options, but also have improved the efficacy and safety of treatment for MS overall. In general, these drugs are “disease modifying agents,” intended to slow down the immune mediated damage to the myelin sheaths that underlie symptoms in MS. However, they often do not adequately address the symptoms that MS patients experience such as walking problems, bladder control, dizziness, and especially pain. A 2022 study estimated that the average cost of treatment for patients with MS is approximately $88,000 annually. The out-of-pocket expense for patients can be significantly reduced through certain insurance plans. However, we believe there is the ability for Apitox to be positioned as an important and cost-effective therapy.

We believe the data from the Apimeds Korea Phase III OA Trial suggest that Apitox may have the potential as an adjunctive therapy for all four types of MS. We intend to Apitox as a potential adjunctive therapy through non-registered corporate sponsorship studies to begin determining the appropriate MS patient populations.

Market Opportunity

We believe there is a significant market opportunity in the United States for Apitox in the treatment of certain symptoms of knee OA and eventually MS. According to Precedence Research the osteoarthritis therapeutics market size accounted for $8.28 billion in 2022 and it is expected to hit around $20.24 billion by 2032, expanding at a CAGR of 9.4% from 2023 to 2032. Although OA can damage any joint, the disorder most commonly affects joints in your hands, knees, hips and spine. OA symptoms can usually be managed, although the damage to joints can’t be reversed. Apitox has certain anti-inflammatory properties, which we believe give it significant potential to help treat the symptoms of certain chronic diseases that involve difficult to control pain and inflammation.

3

According to Pharmaceutical Technology the MS market size in the United States accounted for $10.73 billion in 2022 and is expected to hit $24.4 billion by 2030, expanding at a CAGR of 10.32%. Starting in the first quarter of 2025, we intend to begin the early prosecution of appropriate MS patient populations through non-registered corporate sponsorship studies. Subject to FDA approval, our development of Apitox in the United States will in the near term, have two distinct focuses (i) the treatment of the certain symptoms of knee OA and (ii) the quality of life issues surrounding knee OA, such as pain and lack of mobility.

Living with a chronic disease is challenging, as it interferes with physical, mental, and social functions and thus greatly affects a person’s quality of life. Indeed, chronically ill patients are facing major struggles such as higher expenditures, social isolation and loneliness, disabilities, fatigue, pain/discomfort, feelings of distress, anger, hopelessness, frustration, anxiety, and depression. There is the general assumption that symptom reduction increases a patient’s quality of life. Our approach with Apitox centers around this concept — effectively treating certain symptoms of the patient’s disease, thus improving their overall quality of life. Bee venom has been shown to have anti-inflammatory effects. At low doses, bee venom can suppress inflammatory cytokines such as interleukin-6 (IL-6), IL-8, interferon-γ (IFN-γ), and tumor necrosis factor-α (TNF-α). A decrease in the signaling pathways responsible for the activation of inflammatory cytokines, such as nuclear factor-kappa B (NF-κB), extracellular signal-regulated kinases (ERK1/2) and protein kinase Akt, and porphyromonas gingivalis lipopolysaccharide (PgLPS)-treated human keratinocytes has been associated with treatments involving bee venom. We believe the driver of pain in the highest category of OA is correlated to the key inflammatory elements treated by bee venom, meaning the evaluation of our Phase III data may lead to a small indication for narcotic use reduction in the treatment of stage 4 OA.

Our Product Candidate

Apitox is purified honeybee (Apis mellifera) venom manufactured as a lyophilized powder for reconstitution in 0.5% preservative-free lidocaine (lmg/mg) prior to intradermal dose injections that are administered up to 1,500 micrograms per weekly visit. The biologically active components include melittin (40-50%), apamin (2-3%), mast cell degranulating (“MCD”) peptide (Peptide 401,2-3%), phospholipase A2 (10-15%), hyaluronidase (1.5-2%) and other components in small amounts, including dopamine and norepinephrine. According to a publication entitled “Pharmacological effects and mechanisms of bee venom and its main components: Recent progress and perspective” by Shi et al., certain components of honeybee venom have been found to have both anti-inflammatory and analgesic effects. The anti-inflammatory and analgesic effects are attributed to the presence of Peptide 401, adolapin and other components that inhibit prostaglandin synthesis. The hormone-stimulating effects are attributed to the presence of melittin, cardiopep and other components that stimulate the pituitary-adrenal axis to produce cortisol. Results from an animal study entitled “Effect of bee venom and melittin on plasma cortisol in the unanesthetized monkey” published by Vick et al., indicate that melittin appears to stimulate the production of cortisol from the adrenal gland. The immune-modulating effects, especially as it pertains to MS, are suggested to be mediated by CD4+CD2S+Foxp3+ regulatory T cells (Tregs) that are influenced by phospholipase A2. While the exact mechanism of action of Apitox is not fully understood, research such as the publication entitled “Therapeutic Use of Bee Venom and Potential Applications in Veterinary Medicine” by Bava et al., suggests that certain components in Apitox may ameliorate immune-inflammatory responses associated with MS. Such studies suggested that treatments with melittin prevent inflammatory cytokine expression and produces anti-inflammatory effects. The proposed indication for Apitox is to provide add-on therapy for the signs and symptoms of MS in patients whose condition is relapsing-remitting (RRMS), primary-progressive (PPMS) or secondary progressive (SPMS).

4

Clinical Development History

Founded in 1989, Apimeds Korea pursued a traditional drug development process in South Korea for Apis mellifera, the bee venom API for Apitoxin. Apimeds Korea completed a formal preclinical study to validate dosing and safety for human administration with a focus on antigenicity and toxicology in 1993.

A Phase I trial was completed in 1994, studying the toxicity and safety of Apitoxin in 20 healthy subjects. The purpose of the Phase I trial was to determine if therapeutic doses of Apitoxin was safe and to identify possible side-effects, if any. Injections of Apitoxin were given two to three times a week, for a total of 12 sessions spanning over four to six weeks. Laboratory and physical examination of the subjects included (i) serum cortisol levels (to see if Apitoxin stimulated the release of cortisol), (ii) serum ionized calcium level (to determine if Apitoxin decreased the serum calcium level), (iii) urinalysis, (iv) hematology and blood chemistry, and (v) vital signs. The Phase I trial demonstrated that there were no significant changes pre- and post-testing of the serum cortisol levels, serum ionized calcium levels, hematology, blood chemistry, urinalysis, and vital signs after the subjects were injected with Apitoxin according to the protocol. There were no significant physiological changes in the clinical evaluations of the subjects and localized itching was the most frequent side effect and was managed with ice packs or external anti-itching gels. No severe side effects or aftereffects were observed. The Phase I trial indicated that Apitox is safe for humans when applied in therapeutic doses.

The Phase I trial was followed by a Phase II trial in 101 subjects to determine the efficacy of Apitoxin at various dose levels. This was a randomized active-controlled clinical trial with three groups receiving the study drug at various dose levels and one group receiving the control drug (nabumetone) for a six-week period. Patients received twice weekly injections of Apitox intradermally at dosages titrated to a maximum of 0.7 mg (Group A), 1.5 mg (Group B), and 2.0 mg (Group C) for a period of six weeks. Control group patients (Group D) received 1,000 mg of nabumetone orally each day for the same six-week period. There were 25, 26, 25 and 25 patients assigned to Groups A, B, C and D, respectively. Efficacy of treatment was evaluated by the physician investigators using a 4-point Likert-like symptom severity rating scale developed by the authors to assess Pain, Disability and Physical Signs. A similar 5-point scale was used for patient self-evaluation. Safety of the Apitoxin injection was evaluated by patient reaction, hematologic examination, and laboratory chemistry analysis of blood and urine. Efficacy data was reported for the 81 patients who completed the study. While there were no significant differences in symptom severity scores among the four groups at baseline, symptom scores were significantly better in the bee venom injection groups than in the control group at six weeks and 10 weeks after the start of treatment (p<0.01). A treatment was considered effective if there was a 20% improvement from baseline in symptom scores after 6 weeks of treatment. Based on this definition, therapy demonstrated overall efficacy in 70.0% of patients in Group A, 85.7% in Group B, 90.0% in Group C, and 61.9% in Group D (drug control). Overall efficacy was significantly greater in treatment Groups B and C combined than in the nabumetone-treated control group D (p<0.0177). Importantly, efficacy of treatment among all patients treated with Apitoxin injection was greater than among nabumetone-treated patients for each category assessed: Pain: 85.2% versus 76.2%; Disability: 77.0% versus 71.4%; and Physical Signs: 62.3% vs. 23.8%. It is also noteworthy that, unlike the drug control group, the Apitoxin injection groups continued to demonstrate improved symptom scores at four weeks after the last treatment (10 weeks). There were no significant changes in vital signs or results of laboratory examinations of any patient in this clinical trial. Localized itching was experienced by all patients who received Apitox injections. Itching at the injection site generally lasted for two to three weeks; several patients had this reaction for a longer period. This Phase II study showed that Apitoxin was significantly more effective than the control drug, nabumetone, in the treatment of knee and spinal osteoarthritis patients. It clearly showed that improvement in pain, disability and physical signs was greater in the bee venom injection groups than in the nabumetone control group. No significant side effects developed at the therapeutic doses studied. However, research should be continued to minimize itching and pain at bee venom injection sites, and possible allergic reaction should always be considered with treatment at high doses.

5

In 2002, a formal Phase III double-blind, placebo-controlled trial was completed with 407 subjects (311 of which obeyed the trial protocol and completed the clinical study). The purpose of the Phase III trial was conducted to verify the efficacy and safety of the medicine resulting from the prior Phase I and Phase II trials. The therapeutic course treatment included a total of 12 injections over a period of 6 weeks. Final evaluations were completed in the 8th week, following two weeks of no injections. During the trial period, laboratory tests were carried out three times (before injection, in the second week, in the sixth week), and the efficacy evaluation was performed four times (before injection, in the second week, in the sixth week, and in the eighth week). Safety of the Apitoxin injection was evaluated by, hematologic examination, measurement of cortisol and calcium levels, and laboratory chemistry analysis of blood and urine. The primary efficacy variable for the trial was the ratio of the subjects who showed more than 20% improvement in the total points of test items for efficacy evaluation 6 weeks after injection, compared with the total points before injection of the medicine (the “improvement rate”). Data obtained from subjects of the clinical test were analyzed by two methods, ITT (Intention to Treat) analysis and PP (Per Protocol) Among 310 subjects who participated in the efficacy evaluation, 153 and 157 patients belonged to the Apitoxin group and the nabumetone group, respectively. For the Apitoxin group, the ratio of the subjects who showed more than 20% improvement in the total points was 48.70% (75/154 subjects, 95% confidence interval (“CI”): 40.8~56.6%), while for the nabumetone group, it was 46.15% (72/156 subjects, 95% CI: 38.3~54.0%), indicating that the improvement rate in the Apitoxin group was greater than in the nabumetone group; however, there was no statistical significance. (p=0.6533). Among a total of 407 subjects (Apitoxin group: 204; Nabumetone group: 203), 38.24% (78/204) of the Apitoxin group showed more than 20% improvement during the 6th week of injection, while 38.42% of the Nabumetone group improved by more than 20%, indicating that the two groups showed similar improvement rate (p=0.9688). The second efficacy variable was the improvement rate during the 8th week (2 weeks after the completion of the final injection). According to results from comparing the total points of efficacy evaluation items during the second week after completion of injection (during the 8th week after injection) with the total points before injection, 58.44% (90/154) of the Apitoxin group showed a higher improvement rate than during the 6th week (48.70%), while 42.95% (67/156) of the Nabumetone group showed lower improvement rate than during the 6th week (46.15%). There was statistical difference in total point of efficacy evaluation items between the two groups (p=0.0064). These results suggest that even after treatment stops, the efficacy of Apitoxin continues. With respect to safety, among a total of 407 subjects who participated in the safety evaluation, 69 (33.82%) of the Apitoxin group showed an adverse event, while 59 (29.06%) of the Nabumetone indicated adverse event. These results indicate that the Apitoxin group had an elevated adverse event rate than the Nabumetone group, but there was no statistically significant difference between the two groups (p=0.3526).

In May 2003, MFDA granted approval for the use of Apitoxin in the treatment of pain and mobility in patients with OA. A post-marketing/approval safety study in South Korea followed 3,194 patients from 2003 through 2009, with no serious adverse events or negative safety signals.

In 2013, preliminary Phase III clinical trials were authorized to enroll patients by the FDA to study the same indication approved in South Korea — treatment of pain and lack of mobility in patients with OA. The results of the preliminary Phase III clinical trial indicated statistical and clinically significant improvements in all outcome measures of pain, physical function, and disease assessment in the study group. The study group included 330 patients with diagnosed osteoarthritis of the knee. The subjects were evaluated for relief of pain using Western Ontario and McMaster Osteoarthritis Index (WOMAC) and physician and patient global assessments. The primary efficacy measure was relief of pain and inflammation over a 12-week treatment period after randomization into the trial. The secondary efficacy measure was improvement of mobility. Treatment effect will be compared in a 2-1 Apitox vs active control. Compared with the placebo group (histamine), subjects in the Apitox group who received a maximum dose (1500 micrograms) at each weekly visit over 12 weeks showed a significantly more improvement in all outcome measures (WOMAC pain, WOMAC physical function, visual analog scale (“VAS”) pain, patient and physician global assessments of OA). Further, post hoc analyses showed that a statistically significant greater percentage of Apitox-treated subjects had at least a 40% and 60% reduction in WOMAC pain as compared to placebo-treated subjects. Sensitivity analyses confirmed the validity of the statistical methods and population definitions. The improvements in pain endpoints were highly significant for both the modified intention to treat and per protocol populations and the improvement was sustained during the four weeks following Apitox treatment.

Except for an expected higher incidence of injection site reactions (<5%) in the Apitox group, the overall safety profiles were comparable between the treatment groups. A serious adverse event of the anaphylactic reaction occurred in an Apitox-treated subject because of a quick injection rate. However, the subject was treated, and the event was resolved within one day. The incidence of adverse events overall was similar between the Apitox and Placebo groups (49.0% and 46.3%, respectively), and there were no clinically meaningful changes, within and between groups, in laboratory parameters, vital signs, physical examination, or electrocardiogram results.

6

During Apimeds Korea meetings with the FDA, the FDA highlighted concerns regarding the opioid crisis. As Apitoxin has been previously approved in South Korea, we believe Apitox could be a viable treatment option within the United States after additional clinical investigation, including our anticipated Phase III trial. Initially, Apimeds Korea elected not to pursue the OA indication in the United States based on its evaluation of potential market adoption and the existing competitive environment for OA. Based on results from the Apimeds Korea Phase III OA Trial and correspondence with the FDA, we believe we are now in a position to continue to advance our Phase III trial for knee OA.

We intend to conduct an additional Phase III trial in knee OA. Based on our previous correspondence with the FDA, we have started to design and will implement our Phase III trial to best address our patient population of patients with grade 2, 3 and 4 knee OA, appropriate dosing, and the most effective way to evaluate Apitox in meeting a patient’s needs. This trial will be an update to the plan of execution based on review of data, discussions with former principal investigators from Apimeds Korea. Upon successful completion and FDA clearance of our Phase III trial in knee OA, we will be positioned to submit a BLA.

We intend that the purpose of this trial will be to evaluate the effectiveness of Apitox in the treatment of grade 2, 3 and 4 OA of the knee. The trial will be designed with a specific focus on the identified subgroup from which we see the highest degree of benefit.

The following table summarizes the preliminary clinical trial activity by Apimeds Korea with respect to Apitoxin:

Preliminary Clinical Data in MS Patients

The United States data from the literature on bee venom studies in MS patients, Table A (Hauser et al. 2001) below, showed clinically significant improvements in disability symptoms following treatment.

In Table A, results were categorized into the following groups: dramatic disability improvement (>12 points on the Related Observable Symptom Scale (“ROSS”), good improvement (7-12 points on ROSS), minimal improvement (<7 points on ROSS), no improvement (<2 points on ROSS), and negative (any total negative response on ROSS). Descriptive analysis of the ROSS clinical outcomes showed that more than 68% of MS patients showed some kind of positive improvement in disability (dramatic, good or minimal) and 58% demonstrated a marked improvement (dramatic or good).

Table A. Summary of Patient Disability Improvement to Bee Venom Treatment Using ROSS

| N | % of Participants |

Follow-up Survey (% improvement) |

Related Observable Symptoms Scale (points improvement) |

||||||

| Dramatic | 15 | 29.4 | % | >30%, or | >12 points | ||||

| Good | 15 | 29.4 | % | 10 – 29%, or | 7 – 12 points | ||||

| Minimal | 5 | 9.8 | % | <10%, or | <7 points | ||||

| None | 15 | 29.4 | % | <2%, or | <2 points | ||||

| Negative | 1 | 2.0 | % | Any total negative response | Any total negative response | ||||

7

After 1 year of bee-venom injections, 68.6 percent of participants showed improvement. N = number of participants.

Apimeds Korea used data from its first Phase III clinical trial for OA and peer reviewed publications, including those referenced in Table A above and formal Phase I (the “Castro Phase I Trial”) and Phase II (the “Wesselius Phase II Trial”) publications specific to MS, to support its submission in 2014 of its Investigational New Drug Application (“IND”) 122804 (A Phase III, Multi-Center, Randomized, Double-Blind, Placebo-Controlled, Parallel Group Study to Evaluate the Safety and Efficacy of Apitox Add-on Therapy for Improving Disability and Quality of Life in Patients with Multiple Sclerosis).

Castro Phase I Trial

The Castro Phase I Trial involved a total of nine bee venom nonallergic patients with progressive forms of MS, who were 21–55 years of age with no other illnesses. The subjects distributed across four groups (A, B, C, and D) and followed a structured 1-year immunization schedule. Hyperreactivity to bee venom was evaluated by questionnaire, physical examination, and a battery of hematologic, metabolic, and immunologic tests. Responses to therapy were evaluated by questionnaire, functional neurological tests, and changes in measurement of somatosensory-evoked potentials. While no serious adverse allergic reactions were observed in any of the subjects, four experienced worsening of neurological symptoms, requiring their discontinuation in the study. The observed negative effects could not be conclusively attributed to adverse reactions arising from the administered therapy. Of the remaining five subjects, three reported subjective amelioration of symptoms and two exhibited objective improvement. Despite suggesting safety in this preliminary study, the small sample size precluded definitive conclusions regarding the efficacy of the treatment for MS. Larger and more carefully conducted multicenter studies were required to establish efficacy.

Wesselius Phase II Trial

The Wesselius Phase II Trial involved a randomized crossover study of 26 patients diagnosed with relapsing-remitting or relapsing secondary progressive MS. Participants were assigned to 24 weeks of medically supervised bee sting therapy, or a control period of 24 weeks of no treatment. Live bees (up to a maximum of 20) were used to administer bee venom three times per week. The primary outcome was the cumulative number of new gadolinium-enhancing lesions on T1-weighted MRI of the brain. Secondary outcomes were lesion load on T2*-weighted MRI, relapse rate, disability (Expanded Disability Status Scale, Multiple Sclerosis Functional Composite, Guy’s Neurologic Disability Scale), fatigue (Abbreviated Fatigue Questionnaire, Fatigue Impact Scale), and health-related quality of life (Medical Outcomes Study 36-Item Short Form General Health Survey). The results of the Wesselous Phase II Trial indicated that during bee sting therapy, there was no significant reduction in the cumulative number of new gadolinium-enhancing lesions. The T2*-weighted lesion load further progressed, and there was no significant reduction in relapse rate. There was no improvement of disability, fatigue, and quality of life. Bee sting therapy was well tolerated, and there were no serious adverse events. In this trial, treatment with bee venom in patients with relapsing multiple sclerosis did not reduce disease activity, disability, or fatigue and did not improve quality of life measured using gadolinium-enhancing MRI.

From June 2014 to June 2018, Apimeds Korea corresponded with the FDA and there were no clinical holds at that time. Sponsorship of IND 122804 was transferred from Apimeds Korea to us in October 2020. On September 21, 2021, we responded to customary non-clinical hold comments from the FDA. In November 2021, we received a customary clinical hold from the FDA due to the retirement of the former principal investigator. We have subsequently updated the FDA with a new principal investigator via our Chief Medical Officer, Dr. Christopher Kim. In February 2023, the FDA removed the clinical hold and concluded it may be initiated. We have subsequently made the strategic decision to focus our efforts and capital on our Phase III trial in knee OA, and instead focus our MS efforts on the early prosecution of appropriate MS patient populations through non-registered corporate sponsorship studies.

Our Commercialization Strategy

We are dedicated to the effective implementation of regulatory, clinical and legal strategies to create value in Apitox. The effective execution of this strategy will provide us the opportunity to evaluate and potentially acquire other assets that fit within our space for development.

8

Manufacturing

We intend to continue to engage a third-party manufacturer, Piramal Pharma Solutions, in Lexington, Kentucky to support our Phase III trial and, if Apitox is approved by the FDA, commercial manufacturing. This manufacturer has dedicated experience in development and technology transfer of sterile dose formulations, including liquid and lyophilized formulations.

Research and Development

We are currently engaged exclusively in the clinical development of Apitox for continued use in knee OA through a Phase III trial in knee OA and potential use for MS through the early prosecution of appropriate patient populations through non-registered corporate sponsorship studies.

Sales and Marketing

The healthcare providers associated with the treatment of inflammation and pain management symptoms associated with OA and MS are not limited to one specialist but involve a comprehensive team of providers focused on slowing the progression of the disease along with the physical, emotional and day-to-day management of the condition. Each of these providers represents a potential customer for Apitox.

Apitoxin, which will be known as Apitox in the United States, has established technological credibility through its preclinical testing, Phase I, Phase II and preliminary Phase III clinical studies completed by Apimeds Korea. Apimeds Korea received regulatory approval for Apitoxin by the MFDA in South Korea, as well as long-term safety data from treatment of patients in Korea from 2003 to 2009. There were no serious adverse events from over 3,000 patients monitored, and Apitoxin has been approved and marketed in South Korea for OA since 2003. We update the FDA annually on safety data generated by Apimeds Korea from South Korea.

We aim to obtain FDA approval for Apitox in the United States market for treatment of inflammation and pain management symptoms associated with knee OA, and eventually MS, and expand the indication portfolio in the autoimmune market with a strategic marketing partner. The marketing partner strategy is common in the pharmaceutical marketplace, as the infrastructure, overhead, and barriers to entry dilute the focus and can rapidly erode the financial well-being of small, product development-based companies such as us. By identifying the strategic marketing partner at an early stage, the companies can deliver a final product, or family of products, in a form factor or variety of form factors over time, that specifically suit the target market. We believe that Apitox represents a significant opportunity as a platform technology, with numerous product-line extensions, and the potential for new, ancillary products such as delivery devices.

9

Reimbursement Strategy

Apimeds expects to apply to the Centers for Medicare and Medicaid Studies (“CMS”) for temporary generic reimbursement codes 12 to 18 months prior to a BLA approval. Temporary codes are used until manufacturers apply for, and receive, permanent codes, which identify the drug and its therapeutic class. Permanent codes are issued by CMS on a rolling quarterly basis.

We will engage third party contractors to assist the us with reimbursement, coding and policy development prior to, during and at the time of approval of Apitox. We will look for a contractor to provide the following services to us:

| ● | Coding Assessment and Strategy/Execution — CPT Review of Apitox Administration by Multiple Intradermal Injections. Assess the landscape to ensure a clear understanding of the key dynamics and analyze relevant proxies and precedent. Further assess relevant drug administration codes and whether appropriate codes exist. |

| ● | Medical Coverage Policy Analysis — Provide a framework and set expectations for Medicare’s anticipated coverage approach to Apitox, specifically in the context of intra articular hyaluronic acid use agent coverage policies and implications of their efficacy uncertainty. |

| ● | Medicare Local Coverage Analysis and Implications — Given the significance of Medicare policy standards, local and national Medicare policies often shape payer and provider perceptions and decisions. As complex statutory and regulatory guidance shape Medicare decision-making, ADVI analyzes, investigates, and synthesize Medicare policies that could affect access (coverage, coding and reimbursement) for Apitox. |

| ● | Medicaid and Commercial Coverage Analysis and Implications — Analyze available medical policies for five large state Medicaid agencies (based on population and geographic variation) and major commercial payers (where publicly available). |

| ● | Payer Policy Internal Expert Interviews — Conduct payer interviews with relevant Medicare, Medicaid and commercial policy advisors. |

| ● | HCPCS Coding and Payment Assessment — Assess the coding and reimbursement landscape to ensure Apimeds has a clear understanding of the key dynamics with the HCPCS application process and the Medicare Hospital Outpatient Prospective Payment System (OPPS) pass-through status application process. Through this assessment, identify the areas of concern, expectations, timing, timelines, and processes associated. This is especially relevant given the 2020 implementation of a new HCPCS review process. |

| ● | Address key Part B/medical benefit implications to Apitox in the following fields: |

| ● | HCPCS and OPPS application timelines (and potential evolution leading to launch). |

| ● | Coding/access implications prior to code assignment (e.g., NOC/miscellaneous codes), review the merits/risks of Q-code. |

| ● | further review the application processes, expectations, case examples, timelines, and hurdles that APUS may face across settings of care, payers, and with CMS, |

| ● | Case examples, timelines, and hurdles across settings of care with payers and CMS, |

| ● | Review of reimbursement implications; and |

| ● | Methodologies (ASP, WAC, AWP), role of sequestration, 340B, patient financial burden |

| ● | Develop Payer (with Emphasis on Medicare) Launch Recommendations — Based on the above primary and secondary research, synthesize the discussions and summarize the overall findings of the payer survey, highlighting themes, and provide recommendations and considerations for optimizing market access, given the current and evolving reimbursement landscape. This section will include payer (emphasis on Medicare) launch strategy recommendations (including timeline) and a local/national Medicare engagement strategy. |

10

Competition

We compete in an industry characterized by rapidly advancing technologies, intense competition, a changing regulatory and legislative landscape and a strong emphasis on the benefits of intellectual property protection and regulatory exclusivities.

Like any biopharmaceutical company, we face competition from multiple sources, including large or established pharmaceutical, biotechnology, and wellness companies, academic research institutions, government agencies, and private institutions. We believe our drug candidate will prevail amid the competitive landscape through its efficacy, safety, administration methods, cost, public and institutional demand, intellectual property portfolio, and treatment of the root cause of many age-associated diseases.

Many of our competitors, either alone or with strategic partners, have substantially greater financial, technical, and human resources than we do. Accordingly, our competitors may be more successful in obtaining approval for treatments and achieving widespread market acceptance, rendering our treatments obsolete or non-competitive. Accelerated merger and acquisition activity in the biotechnology and biopharmaceutical industries may result in even more resources concentrated among a smaller number of our competitors. These companies also compete with us in recruiting and retaining qualified scientific and management personnel, establishing clinical study sites, patient registration for clinical studies, and acquiring technologies complementary to, or necessary for, our programs. Smaller or early-stage companies may also prove to be significant competitors, particularly through collaborative arrangements with large and established companies. Our commercial opportunity could be substantially limited in the event that our competitors develop and commercialize products that are more effective, safer, more tolerable, more convenient, or less expensive than our comparable products. In geographies that are critical to our commercial success, competitors may also obtain regulatory approvals before us, resulting in our competitors building a strong market position in advance of our products’ entry. We believe the factors determining the success of our programs will be the efficacy, safety, and convenience of our drug candidates.

Additionally, consumer preference for branded, generic or private label products sold by competitors could adversely impact our financial performance. Our competitors, which differ within individual geographic markets, include large-scale retailers, smaller high-growth companies (which often operate on a regional basis and offer aggressive competition), multinational corporations moving into or expanding their presence in the consumer healthcare market, and “private-label” products sold by retailers.

Our aim is to reduce the use of NSAIDS and opioid use as it relates to the pain management associated with OA. We believe that if approved by the FDA, Apitox may be a non-addictive option to patients experiencing debilitating pain.

Business Agreement

On August 2, 2021, we entered into an agreement with Apimeds Korea, a principal stockholder of the Company (the “Business Agreement”). Pursuant to the Business Agreement, Apimeds Korea granted to the Company a sublicensable, royalty-bearing license to utilize all prior clinical development data associated with Apitoxin, Apitox, and all related names, advance clinical research, develop, manufacture and commercialize and sell Apitox in the United States. In exchange for this license, the Company will pay Apimeds Korea a perpetual royalty of 5% of the Company’s earnings before interest and taxes (as determined consistent with GAAP, derived from the sale or license of Apitox, less any shipping, handling, and insurance charges, credits (arising from returns or other adjustments), discounts, rebates, or allowances of any kind (if any). The Business Agreement can be terminated by mutual written agreement by the parties and will automatically terminate upon the bankruptcy or dissolution of the Company.

Assignment Agreement

On October 12, 2021, we entered into an intellectual property assignment agreement (the “Assignment Agreement”), which was effective as of May 12, 2020, with Apimeds Korea and Dr. Christopher Kim, the Company’s Chairman and Chief Medical Officer and the founder of Apimeds Korea. During Dr. Kim’s engagement with Apimeds Korea, he contributed to the development of the intellectual property as it relates to Apitoxin, which will be marketed in the United States as Apitox (the “Assigned IP”).

11

Pursuant to the Assignment Agreement, Dr. Kim sold, transferred, and conveyed all his rights, title and interest in the Assigned IP to Apimeds Korea. Dr. Kim retained no right to use the Assigned IP. Additionally, the Assignment Agreement acknowledged that the Assigned IP was licensed to us to use via the Business Agreement.

Intellectual Property

Apitox’s API is bee venom, a natural, non-synthetic compound that is not patentable, so we rely principally on trade secrets to protect our rights to Apitox, particularly the method and process of manufacturing Apitox.

Supplier

We purchase venom from our United States supplier, Apico, Inc. (“Apico”), via a letter agreement. Pursuant to the letter agreement, Apico agreed that for a period of ten years, or until November 3, 2031 it would not supply Apis Mellifea venom for pharmaceutical use for any buyer other than us; provided that Apico may also supply Apimeds Korea for its use outside of the United States. The letter agreement excludes customers using venom for immunology, cosmetic or any other “non-pharmaceutical” use. The letter agreement may be terminated upon mutual written consent of both Apico and the Company.

Apico has developed and practices a proprietary method of harvesting venom. It operates under and is certified in current good manufacturing practice regulations enforced by the FDA and has an active and current Drug Master File (“DMF”) with the FDA. DMF’s are submissions to the FDA used to provide confidential, detailed information about facilities, processes, or articles used in the manufacturing, processing, packaging, and storing of human drug products. We have an exclusive relationship with our supplier for pharmaceutical use in the United States and they are not permitted to sell to any other party for pharmaceutical use.

Apimeds Korea has a number of proprietary analytical methods for the classification and identification of specific pharmacologically active fractions of its venom, along with numerous manufacturing processes from filtration, vial filing and lyophilization required to produce Apitoxin. Apitoxin is the only approved and commercially available therapeutic product containing purified and sterile bee venom that is registered as an API in South Korea. The proprietary methods developed and practiced for the commercial manufacturing of Apitoxin include dilution, filtering, vial staging and lyophilization parameters and cycles.

We plan to file Apitox as a BLA with the Centers for Biologics and Research of the FDA following the successful completion of our Phase III trial for knee OA. The FDA provides 12-year market exclusivity at the time of approval of a BLA, with the potential for a six-month extension upon approval for pediatric use. If the BLA is approved, the 12-year period would be retroactive to the date of the application.

We intend to file a U.S. trademark application for “Apitox”.

Regulatory Environment

Government Regulation and Product Approval

In the United States, biological products are subject to regulation under the Federal Food, Drug, and Cosmetic Act (the “FDCA”), and the Public Health Service Act (the “PHSA”), and other federal, state, and local statutes and regulations. Both the FDCA and PHSA and their corresponding regulations govern, among other things, the research, development, clinical trials, testing, manufacturing, quality control, safety, purity and potency (efficacy), labeling, packaging, storage, record keeping, distribution, reporting, marketing, promotion, advertising, post-approval monitoring, and post-approval reporting involving biological products. Along with third-party contractors, we will be required to navigate the various preclinical and clinical regulatory obligations and the commercial approval requirements of the governing regulatory agencies of the countries in which we wish to conduct studies or seek approval or licensure of our product candidate. The processes for obtaining regulatory approvals in the United States, along with subsequent compliance with applicable laws and regulations and other regulatory authorities, require the expenditure of substantial time and financial resources.

12

Government policies may change, and additional government regulations may be enacted that could prevent or delay further development or regulatory approval of any product candidates, product or manufacturing changes, additional disease indications or label changes. We cannot predict the likelihood, nature or extent of government regulation that might arise from future legislative or administrative action.

Review and Approval for Licensing Biologics in the United States

In the United States, FDA regulates our current product candidate as a biological product, or biologics, under the FDCA, the PHSA, and associated implementing regulations. Biologics, like other drugs, are used for the diagnosis, cure, mitigation, treatment, or prevention of disease in humans. In contrast to low molecular weight drugs, which have a well-defined structure and can be thoroughly characterized, biologics are generally derived from living material (human, animal, or microorganism), are complex in structure, and thus are usually not fully characterized.

Biologics are also subject to other federal, state, and local statutes and regulations. The failure to comply with applicable statutory and regulatory requirements at any time during the product development process, approval process, or after approval may subject a sponsor or applicant to administrative or judicial enforcement actions. These actions could include the suspension or termination of clinical trials by FDA, FDA’s refusal to approve pending applications or supplemental applications, withdrawal of an approval, issuance of warning or untitled letters, product recalls, product seizures, total or partial suspension of production or distribution, import detention, injunctions, fines, refusals of government contracts, restitution, disgorgement of profits, or civil or criminal investigations and penalties brought by FDA, the Department of Justice (“DOJ”), and other governmental entities.

An applicant seeking approval to market and distribute a biologic in the United States must typically undertake the following:

| ● | completion of non-clinical laboratory tests and studies performed in accordance with FDA’s good laboratory practice (“GLP”) regulations; |

| ● | manufacture, labeling and distribution of investigational drugs in compliance with FDA’s current good manufacturing practice (“cGMP”) requirements; |

| ● | submission to FDA of an investigational new drug application (“IND”), which must become effective before clinical trials may begin and must be updated annually and when significant changes are made; |

| ● | approval by an independent institutional review board (“IRB”) for each clinical site before each clinical trial may be initiated; |

| ● | performance of adequate and well-controlled human clinical trials in accordance with FDA’s Good Clinical Practices (“GCP”) to establish the safety, purity, and potency of the proposed biological product candidate for its intended purpose; |

| ● | after completion of all pivotal clinical trials, preparation of and submission to FDA of a BLA requesting marketing approval, which includes providing sufficient evidence to establish the efficacy, safety, purity, and potency of the proposed biological product for its intended use, including from results of nonclinical testing and clinical trials; |

| ● | satisfactory completion of an FDA advisory committee review, when appropriate, as may be requested by FDA to assist with its review; |

| ● | satisfactory completion of one or more FDA inspections of the manufacturing facility or facilities at which the proposed product, or certain components thereof, are produced to assess compliance with cGMP and data integrity requirements to assure that the facilities, methods, and controls are adequate to preserve the biological product’s identity, strength, quality, and purity and, if applicable, FDA’s good tissue practice (“GTP”) requirements for human cellular and tissue products; |

| ● | satisfactory completion of FDA inspections of selected clinical investigation sites to assure compliance with GCP requirements and the integrity of the clinical data; |

| ● | satisfactory completion of an FDA sponsor GCP inspection, often conducted at the applicant’s headquarters facility; |

13

| ● | payment of user fees (unless there is a waiver, exemption, or reduction) under the Prescription Drug User Fee Act (“PDUFA”) for the relevant year; |

| ● | FDA’s review and approval of the BLA to permit commercial marketing of the licensed biologic for particular indications for use in the United States; |

| ● | compliance with post-approval requirements, including the potential requirements to implement a risk evaluation and mitigation strategy (“REMS”), to report adverse events and biological product deviations, and to complete any post-approval studies; and |

| ● | completion of any post-approval clinical studies required by FDA, such as confirmatory trials or pediatric studies. |

From time to time, legislation is drafted, introduced, and passed in Congress that could significantly change the statutory provisions governing the testing, approval, manufacturing, and marketing of biological products regulated by FDA. In addition to new legislation, FDA regulations, guidance documents, and policies are often revised or interpreted by the agency in ways that may significantly affect the regulation of biological products in the United States. It is impossible to predict whether further legislative changes will be enacted or whether FDA regulations, guidance, policies, or interpretations will change, and the effects of any such changes.

Preclinical and Clinical Development

Before an applicant can begin testing the potential product candidate in human subjects, the applicant must first conduct preclinical studies. Preclinical studies may include laboratory evaluations of product chemistry, toxicity, and formulation, as well as in vitro and animal studies to assess the potential safety and activity of the drug for initial testing in humans and to establish a rationale for therapeutic use. Preclinical studies are subject to federal regulations and requirements, including GLP regulations, which govern the conduct of animal studies designed to test a product’s safety. None of our preclinical studies to date have been animal studies. The results of an applicant’s preclinical studies are submitted to FDA as part of an IND.

An IND is a request for authorization from FDA to administer an investigational new drug product to humans. An IND is an exemption from the FDCA that allows an unapproved drug to be shipped in interstate commerce for use in a clinical trial. Such authorization must be secured prior to interstate shipment and administration of a biological drug that is not subject of an approved BLA. In support of an IND, applicants must submit a protocol for each clinical trial, which details, among other things, the objectives of the trial, the parameters to be used in monitoring safety and the effectiveness criteria to be evaluated. A separate submission to the existing IND must be made for each successive clinical trial conducted during product development and for any subsequent protocol amendments.

Human clinical trials may not begin until an IND is effective. The IND automatically becomes effective 30 days after receipt by FDA, unless FDA raises safety concerns or questions about the proposed clinical trial within the 30-day time period. In such a case, FDA may place the IND on clinical hold and the IND sponsor must resolve any of FDA’s outstanding concerns or questions before the clinical trial can begin. Submission of an IND therefore may or may not result in regulatory authorization to begin a clinical trial.

FDA may also place a clinical hold or partial clinical hold on a clinical trial following commencement of the trial under an IND. A clinical hold is an order issued by FDA to the sponsor to delay a proposed clinical investigation or to suspend an ongoing investigation. A partial clinical hold is a delay or suspension of only part of the clinical work requested under the IND. For example, under a partial clinical hold, FDA may instruct a sponsor not to enroll any new patients into a study but permit the previously enrolled patients to continue in the study. No more than 30 days after imposition of a clinical hold or partial clinical hold, FDA will provide the sponsor a written explanation of the basis for the hold. Following issuance of a clinical hold or partial clinical hold, an investigation may only resume after the FDA has notified the sponsor that the investigation may proceed. FDA will base that determination on information provided by the sponsor addressing the deficiencies previously cited or otherwise satisfying FDA that the investigation can proceed.

Clinical trials involve the administration of the investigational product to human subjects under the supervision of qualified investigators in accordance with GCP regulations, which include the requirement that all research subjects provide their informed consent for their participation in any clinical trial. If a sponsor chooses to conduct a foreign clinical study under an IND, all FDA IND requirements must be met unless waived. When the foreign clinical study is not conducted under an IND, the sponsor must ensure that the study complies with GCP regulations in order to use the study as support for an IND or application for marketing approval, including review and approval by an IRB and informed consent from subjects.

14

Furthermore, an independent IRB for all sites participating in a clinical trial must review and approve the plan for any clinical trial and its informed consent form before the clinical trial begins at each site and must monitor the trial until completed. Regulatory authorities, the IRB, or the sponsor may suspend a clinical trial at any time on various grounds, including a finding that the subjects are being exposed to an unacceptable health risk or that the trial is unlikely to meet its stated objectives.

Some trials also include oversight by an independent group of qualified experts organized by the clinical trial sponsor, known as a data safety monitoring board (“DSMB”). DSMBs review unblinded study data at pre-specified times during the course of the study. If the DSMB determines that there is an unacceptable safety risk for subjects or other grounds, such as no demonstration of efficacy, the DSMB can make a recommendation to the sponsor to modify or stop the trial.

Other grounds for a sponsor’s decision to suspend or terminate a study may be made based on evolving business objectives or the competitive climate.

For purposes of BLA approval, clinical trials are typically conducted in the following sequential phases:

| ● | Phase 1: The investigational product is initially introduced into a small group of healthy human subjects or patients with the target disease or condition. These trials are designed to test the safety, dosage tolerance, absorption, metabolism and distribution of the investigational product in humans and the side effects associated with increasing doses. These trials may also yield early evidence of effectiveness. |

| ● | Phase 2: The investigational product is administered to a slightly larger patient population with a specified disease or condition to evaluate the preliminary efficacy, optimal dosages, and dosing schedule and to identify possible adverse side effects and safety risks. Multiple Phase 2 clinical trials may be conducted to obtain information prior to beginning larger and more expensive Phase III clinical trials. |

| ● | Phase 3: The investigational product is administered to an expanded patient population to further evaluate dosage, to provide statistically significant evidence of clinical efficacy and to further test for safety, generally at multiple geographically dispersed clinical trial sites. These clinical trials are intended to generate sufficient data to statistically demonstrate the efficacy and safety of the product, to establish the overall risk/benefit ratio of the investigational product, and to provide an adequate basis for product approval by FDA. |

These phases may overlap or be combined. In some cases, FDA may require, or companies may voluntarily pursue, additional clinical trials after a product are approved to gain more information about the product, referred to as Phase 4 trials. Post-approval trials are conducted following initial approval, often to develop additional data and information relating to the use of the product in new indications.

Progress reports detailing the results of the clinical trials must be submitted at least annually to FDA. In addition, IND safety reports must be submitted to FDA for any of the following: serious and unexpected suspected adverse reactions in study subjects; findings from epidemiological studies, pooled analysis of multiple studies, animal or in vitro testing, or other clinical studies, whether or not conducted under an IND, and whether or not conducted by the sponsor, that suggest a significant risk in humans exposed to the drug; and any clinically important increase in the rate of a serious suspected adverse reaction over such rate listed in the protocol or investigator brochure.

A sponsor’s planned clinical trials may not be completed successfully within any specified period, or at all. Furthermore, the FDA or the sponsor may suspend or terminate a clinical trial at any time on various grounds, including a finding that the research subjects are being exposed to an unacceptable health risk. Similarly, an IRB can suspend or terminate approval of a clinical trial at its institution, or an institution it represents, if the clinical trial is not being conducted in accordance with the IRB’s requirements or if the drug has been associated with unexpected serious harm to patients. FDA will typically inspect one or more clinical sites to assure compliance with GCP and the integrity of the clinical data submitted.

15

During clinical development, the sponsor often refines the indication and endpoints on which the BLA will be based. For endpoints based on patient-reported outcomes (“PROs”), the process typically is an iterative one. FDA has issued guidance on the framework it uses to evaluate PRO instruments. Although the agency may offer advice on optimizing PRO instruments during the clinical development process, FDA usually reserves final judgment until it reviews the BLA.

Concurrent with clinical trials, companies often complete additional animal studies, and develop additional information about the chemistry and physical characteristics of the drug and finalize a process for manufacturing the product in commercial quantities in accordance with cGMP. The manufacturing process must be capable of consistently producing quality batches of the drug candidate and, among other things, must develop methods for testing the identity, strength, quality, purity and potency of the final drug. Additionally, appropriate packaging must be selected and tested, and stability studies must be conducted to demonstrate that the drug candidate does not undergo unacceptable deterioration over its shelf life.

BLA Submission and Review

Assuming successful completion of all required clinical testing in accordance with all applicable regulatory requirements, an applicant may submit a BLA requesting licensing to market the biologic for one or more indications in the United States. The BLA must include the results of nonclinical studies and clinical trials; detailed information on the product’s chemistry, manufacture, controls; and proposed labeling. Under the PDUFA, a BLA submission is subject to an application user fee, unless a waiver, reduction, or exemption applies.

FDA will initially review the BLA for completeness before accepting it for filing. Under FDA’s procedures, the agency has 60 days from its receipt of a BLA to determine whether the application will be accepted for filing and substantive review. If the agency determines that the application does not meet this initial threshold standard, FDA may refuse to file the application and request additional information, in which case the application must be resubmitted with the requested information and review of the application delayed.

After the BLA is accepted for filing, FDA reviews the BLA to determine, among other things, whether a product is safe, pure, and potent and if the facility in which it is manufactured, processed, packed, or held meets standards designed to assure the product’s continued identity, strength, quality, safety, purity, and potency. To ensure cGMP, GLP, GCP, GTP, and other regulatory compliance, an applicant must incur significant expenditure of time, money, and effort in the areas of training, record keeping, production and quality control. In addition, FDA expects that all data be reliable and accurate, and requires sponsors to implement meaningful and effective strategies to manage data integrity risks. Data integrity is an important component of the sponsor’s responsibility to ensure the safety, efficacy and quality of its product or products.

For cellular products, FDA will not approve the product if the manufacturer is not in compliance with the GTPs, to the extent applicable. GTPs are FDA regulations and guidance documents that govern the methods used in, and the facilities and controls used for, the manufacture of human cells, tissue, and cellular and tissue-based products (“HCT/Ps”), which are human cells or tissue intended for implantation, transplant, infusion, or transfer into a human recipient. The primary intent of the GTP requirements is to ensure that cell and tissue-based products are manufactured in a manner designed to prevent the introduction, transmission and spread of communicable disease. FDA regulations also specify how HCT/P establishments must register and list their HCT/Ps with FDA and how they must evaluate donors through screening and testing, where applicable.

If the FDA determines that the application, manufacturing process or manufacturing facilities are not acceptable, it will outline the deficiencies in the submission and often will request additional testing or information. Notwithstanding the submission of any requested additional information, FDA ultimately may decide that the application does not satisfy the regulatory criteria for approval.